Irs rental property depreciation calculator

Website 5 days ago IRS has precise rules to determine the propertys useful life and depreciation. According to the IRS.

How To Calculate Depreciation For Federal Income Tax Purposes Tax Reduction Federal Income Tax Income Tax

If you receive rental income for the use of a dwelling unit such as a house or an apartment you.

. IRS has precise rules to determine the propertys useful life and depreciation. Luckily you can avoid depreciation recapture tax on a rental property. In this step you take your cost basis from step one and divide it by the years that your rental property is considered to have a useful life.

Avalara MyLogdeTax calculates rates for your bookings so you dont have to think about it. June 7 2019 308 PM. Generally depreciation on your rental property is the based on the original cost of the rental.

This is known as the. A rental property owner needs to. You calculate depreciation as follows.

Avalara MyLogdeTax calculates rates for your bookings so you dont have to think about it. It provides a couple different methods of depreciation. If the home was not available for rent for the full year.

How to Calculate Depreciation on Rental Property. You bought the property 250000 and 200000 of that was the value of the building rather than the land. 1 Best answer.

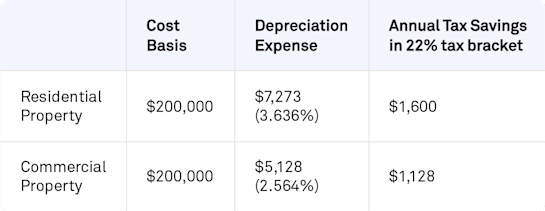

In this case since residential rental property can be depreciated for 275 years you would depreciate 4589 per year. This rental property calculator allows the user to enter all. The IRS considers the useful life of a rental property to be 275 years so the amount of depreciation you can claim each year is your propertys value divided by 275.

That means you can deduct. A rental property owner needs to understand the IRS process. To take a deduction for depreciation on a rental property the property must meet specific criteria.

How do you avoid depreciation recapture on rental property. One of the best methods is to use a 1031. D i C R i Where Di is the depreciation in year i C is the original purchase price or.

IQ Calculators provides a free rental property calculator for its site visitors that automatically calculates depreciation. Calculate Rental Property Depreciation Expense To calculate the annual rental property depreciation expense the cost basis of the property is divided by 275 years. Ad Automatically apply state and local rental taxes for your properties.

415 Renting Residential and Vacation Property. 1st year depreciation 12 month 05 12 cost basis recovery period As you can see the only part of this formula that is different from the standard straight-line depreciation method is. Rental Property Depreciation Schedule Since you spread the depreciation deduction over 275 years you take the cost basis of the building not the land and divide it.

Ad Automatically apply state and local rental taxes for your properties. Divide Cost by Lifespan of Property. MACRS Depreciation Formula The MACRS Depreciation Calculator uses the following basic formula.

You must own the property not be renting or. A rental property depreciation calculator can be a great tool for investors looking to find out the depreciation on their rental property. Depreciation Calculator This depreciation calculator is for calculating the depreciation schedule of an asset.

Increase The Rate Of Return With Cost Segregation Tax Reduction Income Tax Study Help

How To Use Rental Property Depreciation To Your Advantage

Depreciation Recapture What It Is How To Avoid It In 2022 Capital Gains Tax Irs Taxes Savings Strategy

Understanding Rental Property Depreciation 2022 Bungalow

The Sales Proceeds Calculation Home Mortgage Real Estate Investing Rental Property

What The Irs Says About Cost Segregation Federal Income Tax Irs Income Tax

Chh1xbeol4bihm

How To Calculate Depreciation On A Rental Property

The Irs Atg States Tax Reduction Helpful Hints Irs

Bonus Depreciation Calculator In 2022 Savings Calculator Bonus Real Estate

The 721 Exchange Or Upreit A Simple Introduction Estate Planning Capital Gains Tax Real Estate Investor

Pin Page

How To Calculate Depreciation On Rental Property

Residential Rental Property Depreciation Calculation Depreciation Guru

Residential Rental Property Depreciation Calculation Depreciation Guru

Free Macrs Depreciation Calculator For Excel

Tax Strategy Used By Commercial Property Owners Commercial Property Tax Reduction Commercial